For decades, China has been a top priority for American companies looking to expand.

This is because the country’s middle class is simply enormous, growing from 3.1% to 50.8% of the country’s total population between the years 2000 and 2018. According to Brookings, there are now at least 700 million people in China’s middle class, and this group has never had more disposable income to spend on consumer goods and services.

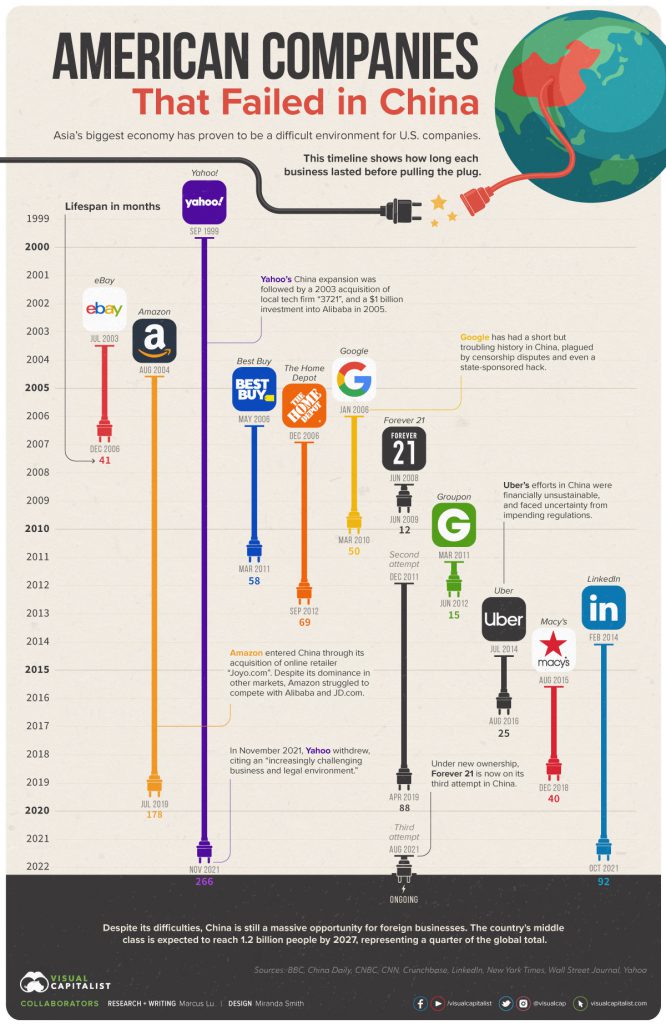

Despite the size and potential of the market, China is not an easy place for foreign businesses to enter. As this infographic shows, many of America’s biggest names eventually admitted defeat.

Some companies have decided to withdraw from the market because they think it’s no longer profitable. Both of these reasons can be broken down into two categories. One reason is that the prices of goods are dropping, and the other is that there are new competitors in the market.

Two American retailers made a mistake by not adapting to the different cultural needs of Chinese consumers. This led to unhappy customers and lost sales.

Best Buy’s sales were down because Chinese consumers were not willing to pay more for name-brand electronics. Other local stores could often find cheaper versions of these products, and as a result Best Buy was losing money on each sale.

Best Buy made a mistake by bringing its large flagship stores to small towns. The stores were too big and couldn’t fit in most people’s neighborhoods, so local shops became more popular.

Home Depot is a retail store that sells a variety of products. It also expanded into China at around the same time as Best Buy, but it was a bit of a challenge because the two cultures are very different.

Home Depot failed to acknowledge that “do it yourself” repairs are not a strong cultural match for China. This is because labor costs are low in China, so many people prefer to do their own repairs rather than pay someone else to do it. On the other side, Home Depot didn’t do a very good job of winning over contractors who do repairs and renovations in China.

The Home Depot didn’t change its product offerings in China, which made it a poor match for local tastes. IKEA has been in China since 1998, and continues to open new stores.

Uber has had a lot of trouble in China because the Chinese government is very strict about how many taxis companies can operate. This has made it difficult for Uber to compete.

American tech companies have a hard time succeeding in China because the Chinese government is very strict about how much control they have over the economy.

Uber tried to enter the Chinese market, but it was very expensive. So Uber gave out a lot of free money to attract customers and drivers, and these efforts only made the company lose money. Then, there were also domestic competitors who were giving out free money too.

Uber ran into several problems when it tried to operate in China. For example, the company needed servers on Chinese maps, and Google Maps wasn’t very accurate in the country. To solve this problem, Uber partnered with Baidu, a Chinese company.

The final straw for Uber was when it learned that the company would need to get approvals from both the provincial and national governments in order to continue operating. Without these approvals, Uber could lose control of its data and be forced to stop receiving subsidies.

Uber realized that doing business in China was too difficult, so they sold their assets to another company. The sale didn’t go as planned, but in the end, it was a success.

Since Uber left, the Chinese government has become more involved in the tech industry, driving more American companies out of the country. Yahoo and LinkedIn, which are now owned by Microsoft, are just two examples.

Both Yahoo and LinkedIn announced that they will be withdrawing from the China in 2021. Yahoo said that it is committed to a free and open internet, while LinkedIn said that the current operating environment and higher regulatory requirements are making it difficult for them to stay in business.

As the geopolitical tensions between the U.S. and China continue to grow, companies that generate data are likely to continue facing regulatory hurdles.

Except tech companies, China is still a massive opportunity for USA businesses. By 2027, the country’s middle class is expected to reach 1.2 billion people, or one quarter of the global total.